Cochrane–Orcutt estimation

Cochrane–Orcutt estimation is a procedure in econometrics, which adjusts a linear model for serial correlation in the error term. It is named after statisticians D. Cochrane and G. H. Orcutt, who worked in the Department of Applied Economics, Cambridge (U.K.).

Contents |

Theory

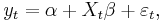

Consider the model

where  is the time series of interest at time t,

is the time series of interest at time t,  is a vector of coefficients,

is a vector of coefficients,  is a matrix of explanatory variables, and

is a matrix of explanatory variables, and  is the error term. The error term can be serially correlated over time:

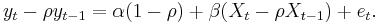

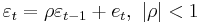

is the error term. The error term can be serially correlated over time:  . The Cochrane–Orcutt procedure transforms the model:

. The Cochrane–Orcutt procedure transforms the model:

Then the sum of squared residuals  is minimized with respect to

is minimized with respect to  , conditional on

, conditional on  .

.

Restrictions

If  is not known, then it is estimated by first getting the residuals of the model

is not known, then it is estimated by first getting the residuals of the model  and regressing

and regressing  on

on  , leading to an estimate of

, leading to an estimate of  and making the transformed regression sketched above feasible. This procedure can be done until in consecutive steps of estimating the correlation coefficient no substantial change is observed. Note that this procedure is designed for an AR(1) error term structure and you would lose the first observation, which might be important for small samples.

and making the transformed regression sketched above feasible. This procedure can be done until in consecutive steps of estimating the correlation coefficient no substantial change is observed. Note that this procedure is designed for an AR(1) error term structure and you would lose the first observation, which might be important for small samples.

See also

Literature

- Cochrane and Orcutt. 1949. "Application of least squares regression to relationships containing autocorrelated error terms". Journal of the American Statistical Association 44, pp 32–61